CARA BELAJAR FOREX

Commerzbank: There was a bullish day reversal candle formed on Monday. Resistance is at 1.1290/1.1325 ahead of 1.1440/1.1534. Still, intraday charts remain negative. Strategists are in small shorts. Support is in the 1.0950 area.

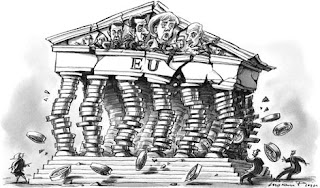

Danske Bank: There will be safe haven flows as uncertainty will remain high ahead of Greek referendum, so EUR/USD and EUR/CHF will go down. The decline may speed up if the first polls show that Greek population is leaning towards a ‘no’ to the referendum proposal.

Westpac: The euro’s dynamics doesn’t match the news flow from Greece: the single currency is holding ground despite the negative implications of the nation’s default. Such resilience in EUR/USD may be explained by the fact that money is pouring into the haven bond markets such as Germany, France and the Netherlands. Month-end and quarter-end add to the difficulty of trading EUR at the moment, with liquidity likely to be thinned by those opting to stand aside.

Barclays Capital: “We recommend staying short EUR/JPY spot and also like being long USD/CHF spot.”

Citi: Buy British pound and Japanese yen versus Australian and Canadian dollars as commodity currencies will get under pressure because of the increased volatility and worse risk sentiment.